డిసెం . 22, 2024 19:37 Back to list

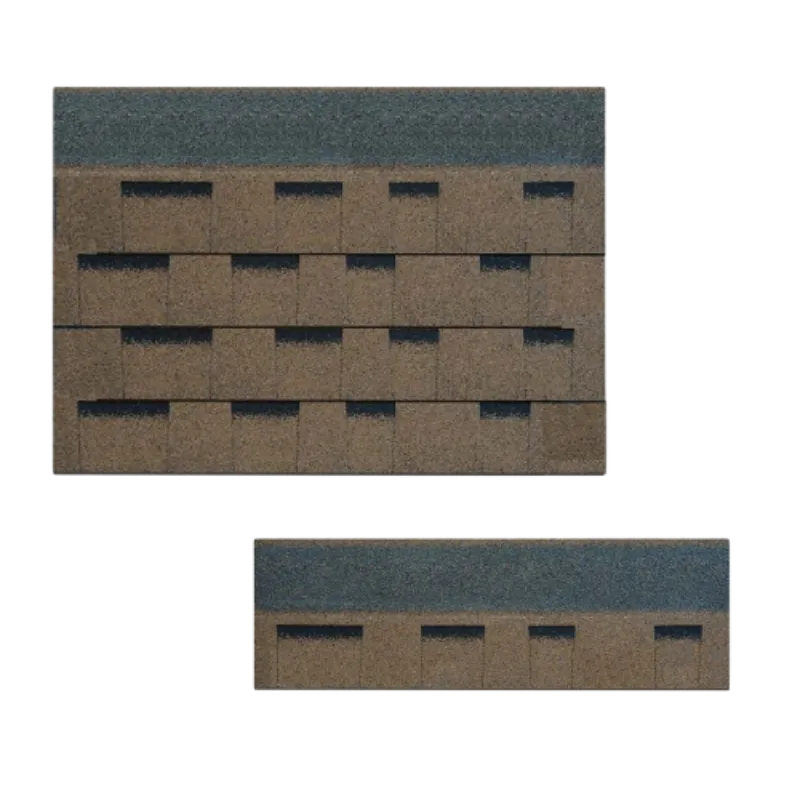

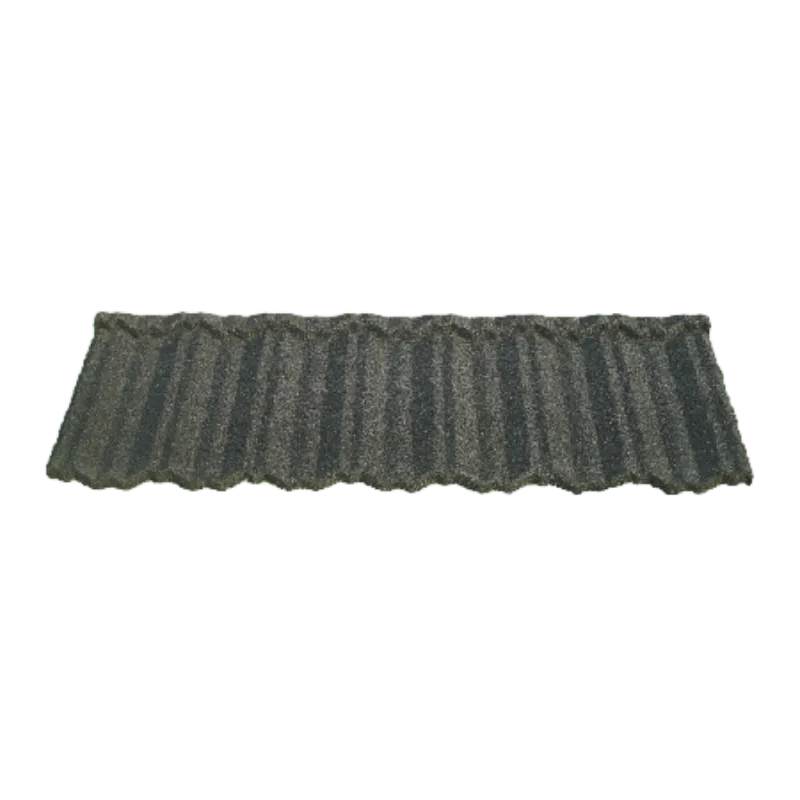

3 tab 30 year shingles

Understanding 30-Year Shingles with a 3% Interest Rate A Comprehensive Overview

When it comes to roof shingles, the term 30-year shingles typically refers to a type of asphalt roofing material that is designed to last approximately 30 years under ideal conditions. However, if we look at it from a financial perspective, particularly in relation to a 3% interest rate, we can draw an insightful parallel in understanding both roofing and financing.

What Are 30-Year Shingles?

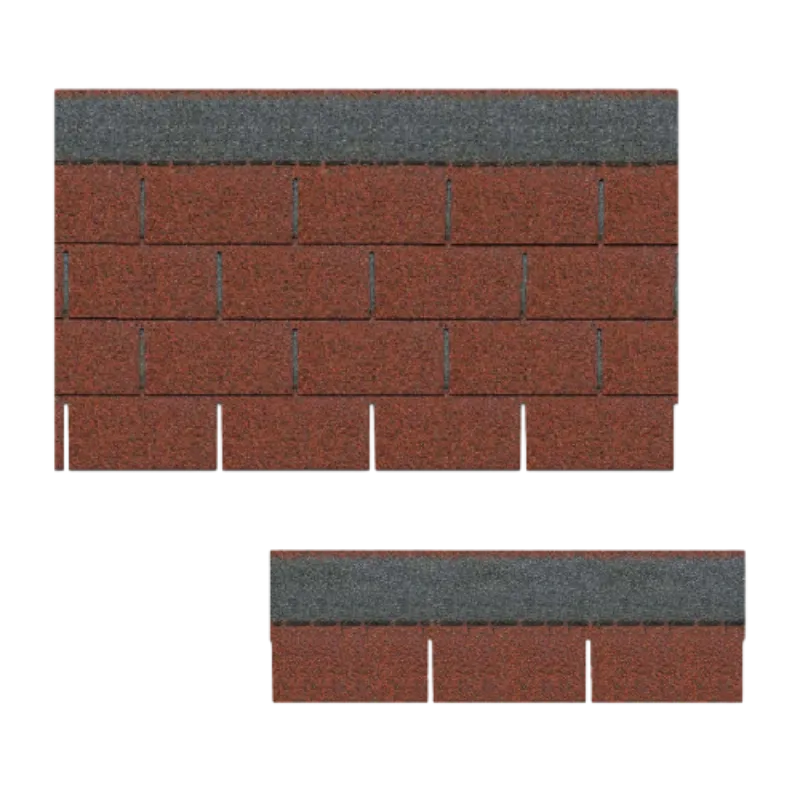

First, it’s essential to define what we mean by 30-year shingles. These shingles are often made of fiberglass and asphalt, providing durability and a robust aesthetic appeal. Their lifespan is longer than traditional 3-tab shingles, which are more prone to wear and tear over time. 30-year shingles are engineered to withstand harsh weather conditions, such as heavy rain, snow, and strong winds, making them a popular choice among homeowners looking for long-term roofing solutions.

One of the standout features of 30-year shingles is their warranty. Most manufacturers guarantee their shingles for 30 years against defects and premature wear. This warranty offers homeowners peace of mind, knowing that their investment will be protected for decades.

The 3% Interest Rate Analogy

Now, let’s shift our focus to the financial aspect symbolized by a 3% interest rate. In financial terms, a 3% rate is often used in mortgages, investments, and loans, representing a steady and manageable cost of money over time. When homeowners finance the purchase of a new roof or home renovation, understanding how a low-interest rate can influence their financing decision is crucial.

3 tab 30 year shingles

Imagine a homeowner considering the installation of 30-year shingles. If they finance this project with a 30-year mortgage at a 3% interest rate, the long-term value of their investment becomes more appealing. The relatively low-interest rate creates an opportunity for homeowners to spread the cost of their roof over three decades, making it more affordable to invest in quality materials that enhance the home’s durability and energy efficiency.

Cost-Effectiveness of Investing in Quality Materials

From a financial standpoint, opting for 30-year shingles can significantly affect the long-term value of a property. Higher quality materials may involve a higher initial cost, but they often lead to lower maintenance costs and fewer repairs in the years to come. By financing this investment at a 3% interest rate, homeowners can allocate their budget more effectively while enjoying the benefits of improved home equity.

Moreover, many insurance companies may offer lower premiums for homes with durable roofing, further enhancing the cost-effectiveness of investing in 30-year shingles. Homeowners can appreciate the protective benefits of their investment while managing their financial obligations responsibly.

Conclusion

In conclusion, the conversation around 30-year shingles and a 3% interest rate serves as a fascinating intersection between roofing durability and financial planning. Investing in high-quality roofing materials like 30-year shingles not only ensures a reliable shelter over your head but also contributes positively to your home’s market value and your financial well-being. By considering the long-term implications of both roofing choices and financing options, homeowners can make informed decisions that benefit them today and in the future. Ultimately, the combination of quality roofing and favorable financing can lead to enhanced peace of mind and satisfaction in homeownership.

-

Composition Shingle Types Durable 3-Tab & Asphalt Roofing Solutions

NewsMay.13,2025

-

Metal & Asphalt Roof Combinations Durable, Energy-Efficient Solutions

NewsMay.13,2025

-

40-Year Architectural Shingles Prices Durable & Cost-Effective Roofing

NewsMay.13,2025

-

Asphalt Shingle Flashing Durable Leak-Proof Roof Transition Solutions

NewsMay.12,2025

-

Grey Roman Roof Tiles Durable Smooth Double Roman Design

NewsMay.12,2025

-

Terracotta Clay Roof Tiles Durable, Insulating & Timeless Design

NewsMay.11,2025